Can You Afford NOT To Purchase Your PV Solar Array?

Can You Afford NOT To Purchase Your PV Solar Array?

Can You Afford NOT To Purchase Your PV Solar Array?

In this piece, we’re going to explore the differences between leasing and purchasing solar and then dig into the returns on investment that can be realistically expected from obtaining a solar array of your very own for your home or business.

According to Consumer Reports, the vast majority of Americans who go solar (72%) are leasing their panels or are participating in a Power Purchase Agreement (PPA). With virtually no upfront costs, it is no surprise that the vast majority of Americans are choosing to go solar with a Lease/PPA. It’s predictable that the high introductory costs associated with PV solar causes a lot of people to move away from purchasing and towards the alternatives presented by leasing and PPA’s. In doing so, they lose out on the real financial benefits that accompany the purchase of their own PV solar array.

We recently heard someone say that, “purchasing a PV solar array costs as much as a car note!” It sure does, but what solar gives back is what makes this a poor comparison. When looking past the initial similarity in price tag, purchasing solar makes a great long-term investment; a car does not. You may pay the same amount for a car, but the difference is that once you’re done paying down the solar array you will be looking at a predictable and reliable source of additional income for the remaining life of the system (10-15 years). That’s 10 – 15 years of free energy!

Of course we’re being a bit prejudiced, but we really do think that investing in solar is a wise choice and something worth pursuing.

Break It Down Now: What’s the Difference Between a Lease and a Power Purchase Agreement?

While leasing entails that you pay a set price every month for the panels on your roof, with a Power Purchase Agreement you purchase the energy generated by the array per kWh. For example, if you are leasing a 10kW solar array from a leasing company for an agreed upon price of $200/month, you will be paying the leasing company $200/month regardless of how much energy the array produces. If you had a Power Purchase Agreement for the same size system, instead of monthly installments, you would be paying an agreed upon price per watt and your cost would be based on the amount of energy that the system produces. At the end of the day, both add up to the same thing: you do not own the panels and do not have access to the considerable financial advantages associated with going solar. In our newsletter and blog, we’ve recently highlighted the incentives available to Marylanders who choose to go solar, so let’s take a brief moment to look at Solar Leasing and PPA’s and the drawbacks associated with them.

The Financial Disadvantages of Leasing and PPA’s

In a Leasing/PPA situation, the solar company essentially has ownership of the roof they install on. In common parlance it is suggested that you are leasing the panels from them, but in fact, it’s the other way around; the Leasing/PPA company is leveraging your roof as a means to turn a profit, while enticing the lessee with modest savings and no upfront costs. Why do I say this? Several reasons:

Loss of Incentives

There are several “payback” financial incentives given out by the Federal government, State government and sometimes even Local governments (refer to blog to see the incentives available to Marylanders) that are forfeited when a system is leased. This also includes the value-added benefits of solar: Solar Renewable Energy Credits (SRECs) and Net Metering.

Let’s say that you have a system that is generating 12,000 kWh a year. In this instance, you would be entitled to 12 SRECs whether you use the energy or not. Depending on market rates that’s an additional $216-$2,220 a year. Using that same scenario, if you’re generating 12,000 kWh a year, but only using 9,000 kWh a year, not only would you be paying nothing for electricity, but according to the Net Metering laws set in place, your utility would have to pay you for the additional energy you provided for the grid. Utilities in Maryland pay 7-9 cents a kWh and will pay PV solar array owners for the energy provided if it has a net worth of over $25. Additionally, the installation of a purchased PV solar system here in Maryland is a home improvement that cannot be added to your Property Tax assessment as an improvement to be taxed. Pretty awesome!

Lastly, the purchase of a system has the potential to free you from having to pay for your electricity for 25-30 years. A Lease or a PPA will never free you from that cost. Purchasing your own PV solar array is an investment that keeps on giving!

Selling a Home

Due to the long nature of Lease and PPA agreements, it is often the case that the original lessee may want to sell their home at some point during the term of the contract. This is made more difficult if the homeowner does not own their panels. When it comes to selling, the homeowner has a few options, they can Transfer the Lease/PPA to the new homeowner, prepay the agreement, have the system moved to their new home, or in the case of a PPA they can purchase the system outright (losing out on incentives already redeemed by the company you signed the PPA with).

When it comes to transferring your Lease or PPA, the homebuyer must meet certain qualifications: they must be willing to assume all of your rights and obligations under the agreed upon contract, in addition to qualifying for one of these three typical standards: having a FICO score above a particular level (usually about 650), by paying in cash for the home, or be willing to pay a $250 “credit exception fee.” Once these qualifications are met the transfer can go through to the buyer.

If the homebuyer does not want to go this direction, the homeowner has the option of Prepaying the Lease/PPA and just transferring the Use of the System. If this sounds like an awful option, do not worry, you are a completely sane person. With this option, you are essentially purchasing a solar system for your homebuyer that the homebuyer will only get to utilize for the amount of time left on the contract. During this time, they are responsible for all parts of the contract except for the monthly payment portion. This is very appealing for the homebuyer, as they essentially get a free solar system.

With moving the system you have two options. You can get the lessor to move it for you or you can go with a third party. It is wise to go with the lessor as getting a third party to move the system could potentially void any limited warranties that may be in place. This can be costly though. The price can be different depending on the installer. From the contracts we have seen, the installer requires that they perform an audit of the new property for $499. Then, if they deem the new property viable, they will perform the move for a minimum of $499. Imagine all your moving expenses, then add at least $1,000.

Although we have not seen this offered in a lease, in a PPA you have the option to purchase the system before the expiration of the contract. This can be done by calculating the amount you would have paid by using a production estimate and then multiplying that by the average kWh price you would have been subject to (times a 5% discount – maybe to make up for the fact they know they are overcharging?). Either way, if you think there is a chance you will sell your home in the next 25 years, read your lease or PPA terms and conditions very carefully…They don’t make it easy!

Additionally, by signing a lease or PPA agreement, there is a significant loss in potential home value. It is proven that adding a purchased solar system to your home increases its overall value. Then when you factor in the extra hassle of transferring or moving that leased/PPA system, you could even say you are depreciating the value of your home in a potential homebuyer’s eyes; not to mention the extra costs you could incur by having to buy out the remainder your contract.

Economy of Scale and Quantity Over Quality

Another drawback to big solar companies leasing or PPA option is that they are working within an economy of scale that does not see you as an individual. As of 2015 SolarCity boasts 190,000 customers in 16 states and have access to 190,000+ roofs from which they can deploy solar. In the lease/PPA business model, the solar array that they’re installing is an investment for the lessor and their backers, not for the lessee. While the Leasing/PPA scenario may be cheaper at the outset, the long term savings and benefits are modest.

Because they’re working within a much larger economy-of-scale Leasing/PPA companies do not need to spend as much money on equipment, nor do they need to confine themselves as strictly to the optimally-oriented roofs. We often have customers ask us why we do not install on northern facing roofs. In short, they do not produce as well since they face away from the most direct sunlight. Why would you pay full price for a panel that will, at best, only produce 50% – 75% of its maximum production? This is different for lease/PPA companies who are getting fixed payments from their customers, plus the added incentives, Net Metering benefits and SRECs. For lease/PPA companies the best bang for the buck is quantity over quality.

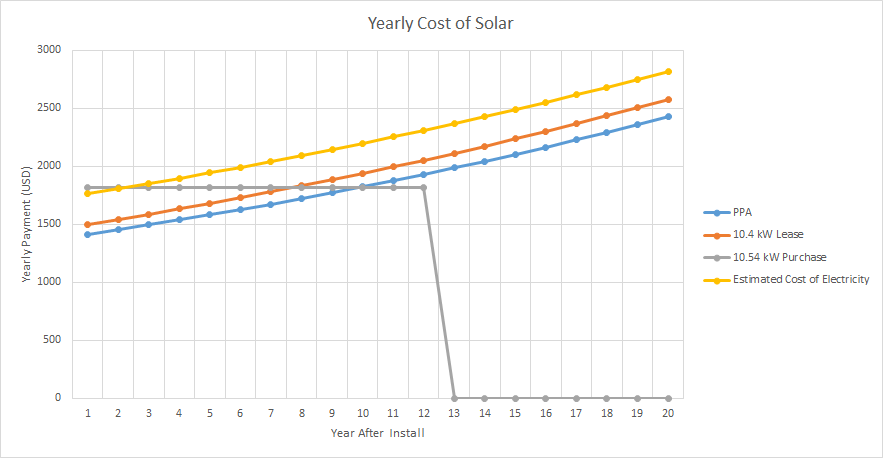

Figure 1: The figure above is determined using the rate of inflation for electricity in the US since 2000 and the current cost of electricity for residences in Maryland. The Lease and PPA numbers are from ACTUAL contracts from the largest Leasing/PPA company in the U.S. The Purchase numbers come from a system designed to closely mirror the size of the lease system utilized by the aforementioned Leasing/PPA company’s contract. The PPA system size is irrelevant as PPA costs are determined by power produced and not the overall size of the system. When placed at the optimal tilt and direction, each of these system sizes will cover all electrical usage of the average Maryland resident. The purchase numbers take into account all incentives that would be received (Federal ITC, Maryland Grant, SRECs, and Net Metering Benefits). The purchase numbers DO NOT take into account the amount of value a homeowner has added to their home. The lease and PPA take into account NO benefits as leases and PPA’s forfeit such incentives to the lessor.

Overall Cost Benefits of Purchasing PV Solar

When comparing the yearly costs for solar, purchasing is the only way to go. As seen in Figure 1, the yearly cost for purchasing your system stays consistent for the entire duration of the payback (assuming you took out a loan; if you paid completely out of pocket, you would expect to see no yearly costs) while the yearly cost of a Lease/PPA only rises by the predetermined escalation rate. While designed to ensure that you would not be paying more for your solar-generated electricity, this escalation rate may not actually result in lower payments. It is quite possible that you could be paying more for the power from the array than you would have paid staying on the utility after as little as ten years. This is due to the fact that the yearly PPA kWh price may rise faster than the prices per kWh that the utility could be offering. This is stated and built into the contract- we call this the “kicker.” The main reason the PPA company includes this inflated escalation rate is to maintain a steady, consistent revenue stream. Since the value of the SRECs generated by the system you are leasing steadily decrease in price, they must increase the amount they get from you per kWh to compensate for the loss.

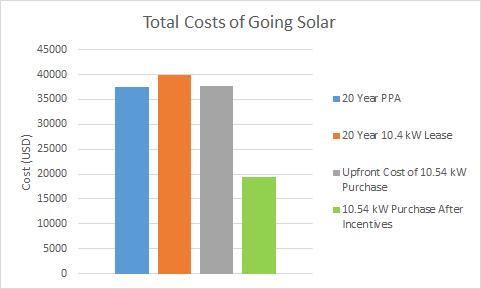

At the end of the lease or PPA term, you will have spent as much money on your system as you would have with a purchased system. When you include the amount you would have gotten back in incentives, you actually end up paying substantially more for your solar system, as shown in Figure 2.

Figure 2: The graph above compares the total amount of money spent on a SolarCity PPA, SolarCity Lease, and MSSI Purchase both before and after incentives. All Lease and PPA numbers are from a standard 20 year contract.

Those are just upfront costs and totals!! When you begin to compare savings, you begin to wonder why anyone ever chooses a Lease or PPA Agreement!

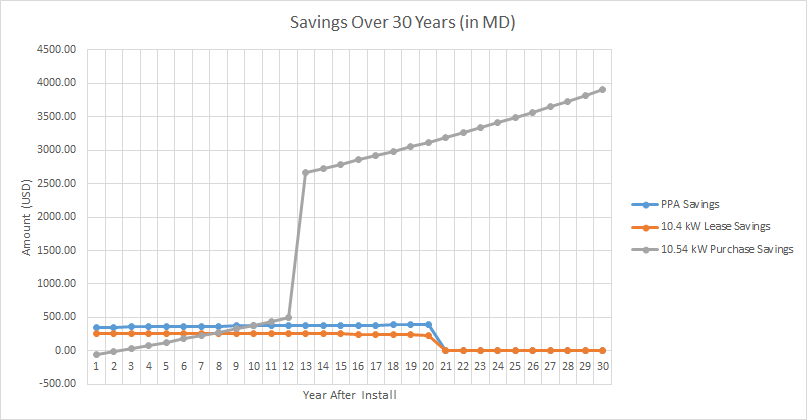

The Long Term Gains Associated with Purchasing PV Solar

Although a PPA/Lease is initially a cheaper option, when it comes to the long term gains, purchasing is, without a doubt, the most financially beneficial way to go solar. When you lease or sign a PPA, you are paying continuously for the full length of the contract, which is conventionally 20 years. With a purchased system, you are expected to be receiving energy for 25-30 years. This is an extra 5-10 years of solar energy and if your system paid for itself (through the avoided electric purchase from the utility and incentives) in 10-12 years (the average for purchase system paybacks), you would be seeing 15-18 years of free energy. This can catapult your savings! Not only are you no longer paying for your system, you are getting free energy, money for your SRECs, you have increased the value of your home, and you are potentially getting paid by your utility! In figure 3 you can see this in action. Initially, with the Lease and PPA, you are saving more. Then around year 8-10 the purchase option surpasses the Lease and PPA in savings. Once you hit that 12-year mark (on average), it is off to the savings races!

Figure 3: The amount of savings you would experience with the same 3 solar options used previously.

Figure 3: The amount of savings you would experience with the same 3 solar options used previously.

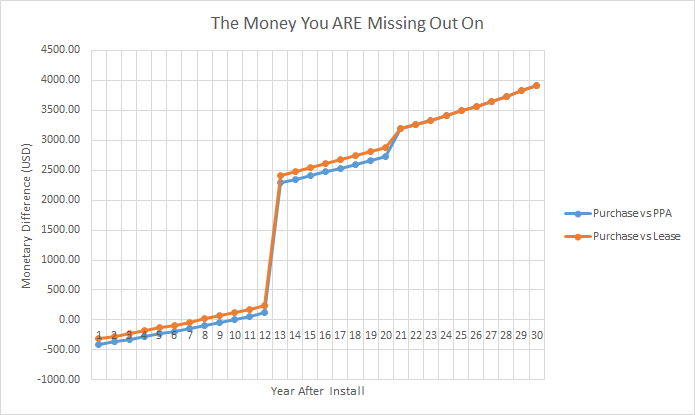

Figure 4: The difference in savings between purchasing and the other two solar options.

Figure 4 illustrates in more detail the money you could lose out on by not choosing to purchase your system. By the end of your system’s life, the average homeowner in Maryland, with a system built to cover their energy needs, would see tens of thousands of dollars in revenue that they would never acquire had they gone with a Lease or PPA Agreement. When you look at the long-term advantages, the option on whether to purchase your system or not becomes a no-brainer.

At the End of the Day…

If going solar is something you have been considering, you should now know that Leasing or signing a PPA Agreement is not an exemplary method to leverage your dollars. It makes it difficult to sell your home, you forfeit all financial benefits, and in the end you miss out on at least 5 figures of savings. No matter which path you choose, we urge you to thoroughly assess your contract and Terms & Conditions.